Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

Income Protection Insurance is designed to replace your lost income if you cannot work due to an extended illness or injury.

There are two ways to obtain Income Protection Insurance: one is to buy an individual policy, and the second is through your employer, if offered by your employer.

The pros and cons of each are as follows.

Pros:

Cons:

Pros:

Cons:

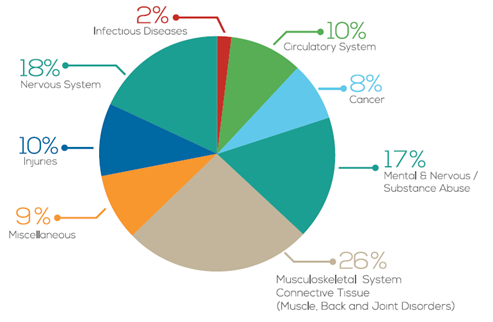

The most common causes of lost wages due to an extended illness or injury are as follows:

Some people think that Social Security Disability will take care of them if they can longer work due to an accident or illness. Applying for Social Security Disability is not an easy task, nor is it easy to qualify for benefits.

You can learn more about Social Security Disability at www.sss.gov/beneifts/disability

People often think a disabling injury or sickness is a rare thing and something they think would never happen to themselves.

Over my long career, I have seen and worked with friends whose spouses were on total disability, as well as former co-workers. In each case, if you looked at those individuals you would think they are ok, but in reality, they can longer work due to a significant health event.

In two different situations, a single back injury ended accountants’ careers because they could not sit at a desk for any extended period of time to work.

One of my co-workers and his family were in a head-on collision. They all walked away from the accident, however, my fellow agent had a traumatic brain injury that ended his career and the ability to work in any capacity. His TBI was life-altering.

The wife of one of my best friends from high school had a high paying, high-level job in finance. In her early 30’s, while pregnant with their last child, she had a brain aneurysm that ended her career thirty years ahead of their plans. She has been receiving disability income benefits over that long time frame.

Think very carefully before you say no to having income protection insurance.

We work with multiple insurance companies so we can match the correct company to your occupation, age, and health status.