Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

Many people today in their 40’s and 50’s are dealing with aging parents who can no longer care for themselves without specialized healthcare help. This brings up a question in their mind, “is there something I should be doing now to help offset the future cost of my specialized healthcare needs?”

The financial cost can be overwhelming, aside from the emotional toll. In 2021, the average cost of a nursing home private room was $9,034 per month, and a semi-private room was $7,908 per month.*

If you would like to study more about the cost of care in your area, a good resource is Genworth Financials Cost of Care Survey:

https://www.genworth.com/aging-and-you/finances/what-is-long-term-care.html

As our society deals with increasing life spans the odds are we will each get to the point in life where we need help beyond what a spouse or children are capable of providing. This type of specialized healthcare falls into several categories:

Home healthcare services

Adult day care

Independent living facility

Assisted living facility

Nursing homes

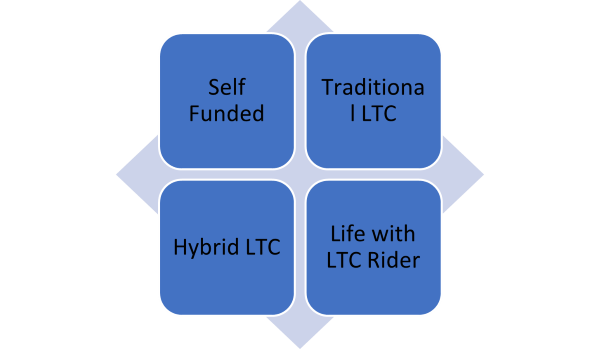

Part of financial planning is addressing the funding of this future specialized healthcare you will likely experience. There are several options to consider:

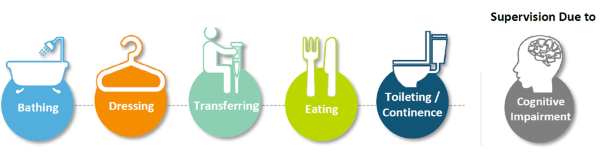

When you buy a long-term care insurance policy, to qualify for benefits you generally need satisfy 2 of the 6 activities of daily living, which are:

Also, remember that this kind of care is not restricted to the aged. I have friends in two different situations who, in their 50’s, were struck with Parkinson’s, and both ended up in a care facility well before anyone would have anticipated.

Some people are under the impression that Medicare or Medicaid will cover them for long-term care expenses. This is a common misconception.

First, Medicare would only cover a nursing home stay if it is after a hospital stay and rehabilitation services are required, in other words “skilled care”. Medicare pays 100% of the cost for the first 20 days. From day 21 to 100, you are on the hook for $194.50 per day, and after 100 days, you are responsible for the full cost.

Medicare does not pay for custodial care, which is what we think of as normal nursing home expenses.

For more information on what Medicare covers, go to:

www.medicare.gov/what-medicare-covers

Next, Medicaid is a federally and state funded program for low-income people. Medicaid only covers you for nursing home expenses in a semi-private (shared) room. And then only after you spend-down (the “Spend-down” rule) most of all your existing assets.

This means you first must pay for your care by depleting your retirement savings, other savings, property assets including your home (there is an exception for your living spouse), etc. In other words, once you have nearly zero assets left, then Medicaid will kick in.

Each state has different Medicaid spend-down rules. Research the rules for your state.

Questions to consider when thinking about long-term care planning:

We are here to help you consider all the options available to you and how those options help you meet your goals and objectives.

As fiduciary advisors, our job is to help you make sense of the options and then determine which option makes the most sense for you based on your goals, objectives, and financial considerations.

*Genworth Cost of Care Survey 2021