Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

Request a No-Cost Consultation

Toll Free: (888) 770-0004

Phone: (303) 770-7078

We have multiple portfolio options from the very conservative portfolio to the aggressive portfolio all to match your risk tolerance and objectives. The portfolios are built using traditional mutual funds or exchange traded funds.

These portfolios follow the Efficient Frontier of investing developed by Harry Markowitz in 1952. Dr. Markowitz was a professor of economics at the University of California, San Deigo. He pioneered work in the concept known as Modern Portfolio Theory.

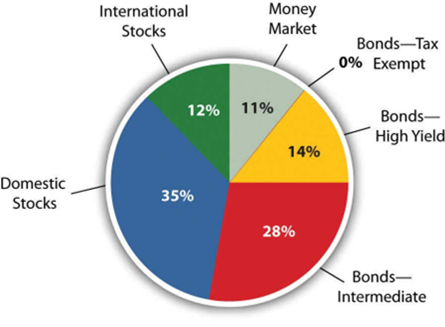

Below is an example of what a “Moderate” portfolio of roughly 50% stock and 50% bonds could like:

The above is a “middle of the road” portfolio example. A more aggressive, thus riskier portfolio may have 80% stock funds and 20% bond funds. And a more conservative, and less risky portfolio may have a mix of 20% stock funds and 80% bond funds.

The objective is to determine through a disciplined process where you fit on the spectrum from conservative to aggressive investor and then match you to the appropriate portfolio.

We also use several institutional fund management firms, so if one firm falters or is not a good match, we can consider an alternative firm. The portfolios usually consist of low-cost exchange traded funds (ETF’s) but could include no-load managed mutual funds.

Annually we review the fund portfolio performance and any changes in your personal life which could change your ability to accept more, or less risk. If warranted, and agreed upon, we will adjust your portfolio selection.

Our ongoing effort to make sure we have a portfolio aligned with your risk tolerance and return objectives and that the portfolio managers are performing as expected.